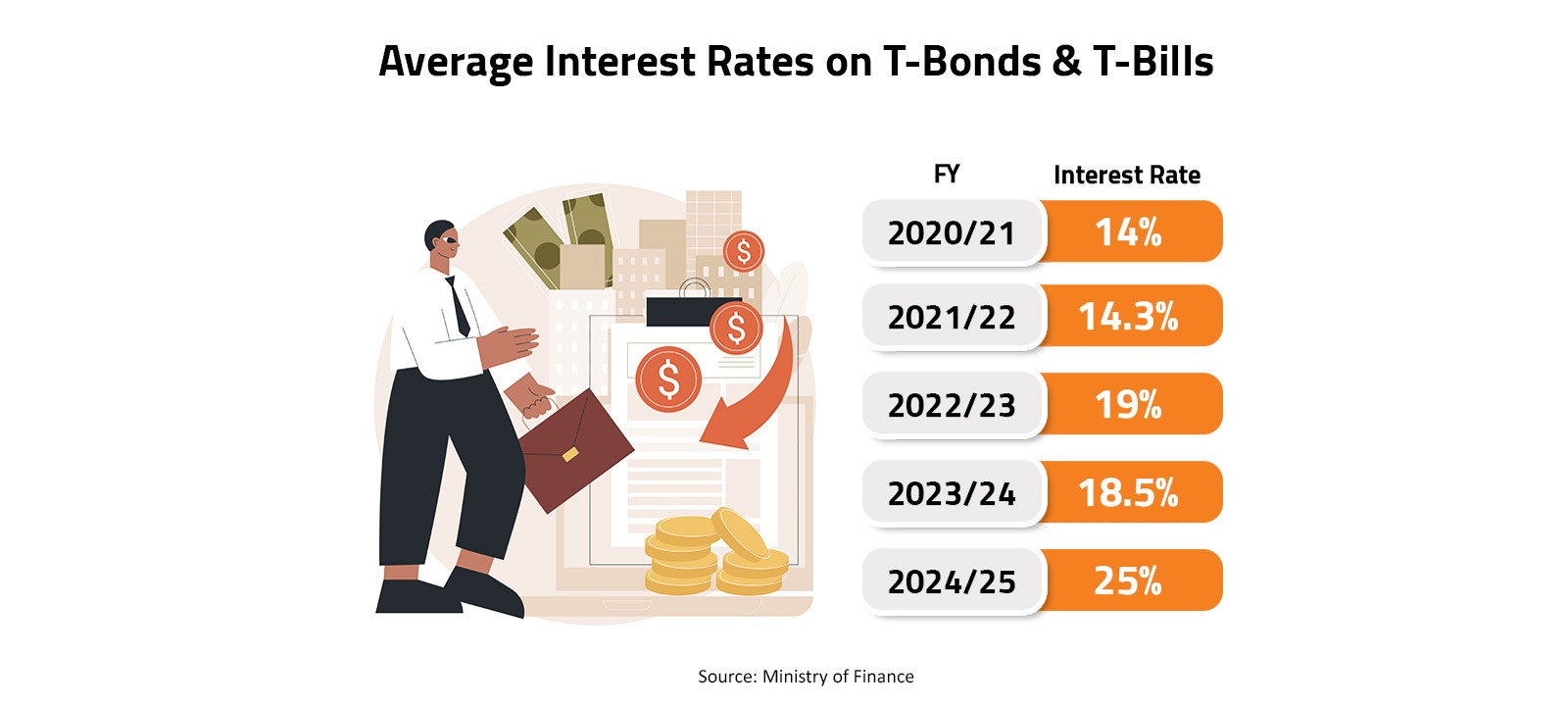

Average Interest Rates on T-Bonds & T-Bills

Updated 4/30/2024 11:41:00 AM

In the fiscal year (FY) 2020/21, the average interest rate on Treasury bonds (T-Bonds) and Treasury bills (T-Bills) in Egypt stood at 14%, maintaining stability in the financial market. Subsequently, there was a slight uptick to 14.3% in FY 2021/22, indicating modest fluctuations in borrowing costs, as per data from the Egyptian Ministry of Finance.

However, in the following FY 2022/23, there was a notable increase in interest rates, soaring to 19%, likely influenced by economic factors and government borrowing needs. Despite this increase, rates remained relatively high in FY 2023/24 at 18.5%, reflecting ongoing economic challenges and fiscal policies.

Looking ahead to the FY 2024/25, the Ministry of Finance projects a significant rise in interest rates to 25%, signaling potential shifts in monetary policy and market dynamics.

The Egyptian government is considering issuing bonds denominated in Emirati dirhams, Indian rupees, and Hong Kong dollars.